Queste opzioni assicurano transazioni immediate a fine di accingersi a puntare mediante denaro veri senza attese. L’app ufficiale di WinSpark Confusione è disponibile per dispositivi iOS e Android, consentendo un entrata rapido e semplice a qualsivoglia i giochi offerti dalla piattaforma. L’app è stata sviluppata con lo scopo di garantire la aforisma compatibilità con la maggior nasce dei dispositivi mobili, permettendo di puntare senza rallentamenti o problemi tecnici. (inter all’app, i giocatori possono ricevere notifiche costruiti in periodo evidente su nuove offerte speciali, offerte speciali e aggiornamenti, assicurandosi successo non dissipare nessuna opportunità.

Vantaggi Vittoria Winspark Casino Con Lo Scopo Di I Giocatori Italiani

Numerosi clienti vengono effettuate rimasti soddisfatti ancora oggi qualità della piattaforma. Presente disegno è operativo da più vittoria 10 anni e soddisfa costantemente i fan del gioco d’azzardo costruiti in sito web winspark tutto il universo. Ora puoi unirti al sito a fine di mettere alla prova la tua sorte con le condizioni più confortevoli.

Sul Il Suo Primo Acconto

In Altezza Su Winspark, il nostro team di aiuto è costantemente pronto a rispondere a qualunque domanda o esitazione quale possa sorgere durante la tua competenza sul nostro sito. Reperibili 24 ore in altezza su 24, 7 giorni su 7, i nostri operatori sono raggiungibili in diversi modi per offrirti l’assistenza di cui hai bisogno. Persino la possibilità vittoria adempiere i pagamenti e i prelievi via PayPal e PostePay dovrebbe esserci implementata con lo scopo di incrementare il levatura del casino e il suo apprezzamento da inizia degli fruitori. Winspark mobile non si discosta da la suddetta partito, e mette usabile un sito internet responsive osservando la grado successo adattarsi perfettamente a ciascuno i device mobili con metodo operativo Android o iOS. La piattaforma si propone però di accrescere l’offerta in futuro, al fine di aderire il maggior numero fattibile di appassionati. Il bonus del 100% sul primo anticipo è poco allettante relativamente all’offerta dei portali più celebri, considerando quale il bonus limite ottenibile è vittoria soli 200€.

- Questa sezione offre l’inquietudine del gioco dal vivo mediante la comodità della piattaforma del web, creando un’atmosfera coinvolgente con lo traguardo di scommesse mediante contante veri.

- Presente grado di servizio mi fa sentire valorizzato e sicuro durante le mie sessioni vittoria gioco.

- Al istante, Winspark non offre un’applicazione mobile dedicata con lo traguardo di dispositivi Android o iOS.

- WinsPark effettua tutte le transazioni secondo le scadenze stabilite.

- WinsPark Casinò rimborsa il cashback settimanale magro al 20% ai propri clienti.

Posso Scommettere In Altezza Su Winspark Casino Dal Mio Smartphone?

Proteggiamo la tua esperienza mediante crittografia SSL a 256 bit. Usiamo sistemi RNG certificati, verificati regolarmente per l’equità. Offriamo limiti vittoria deposito e strumenti vittoria auto-esclusione a fine di promuovere il gioco affidabile. Winspark Confusione permette vittoria scegliere tra opzioni sicure con lo traguardo di depositare e prendere soldi reale. Accettiamo vari metodi, fra cui carte vittoria credito e e-wallet, mediante transazioni rapide e standard alti. Le piu importanti offerte avvengono sempre disponibili sul sito di Winspark Confusione per i giocatori osservando la La Penisola.

⃣ Winspark Ha Un Bonus Senza Deposito?

Consigliamo la live chat con lo traguardo di una risposta più veloce e interattiva. Il nostro lavoro è disponibile osservando la diverse lingue, inclusa la idioma svizzera, per garantire quale tu possa comunicare mediante noi nel modo più agio fattibile. Al attimo Winspark non dispone di una sezione dedicata al casino live. I giocatori il quale desiderano mettersi alla prova con le sfide in diretta streaming con croupier professionisti devono perciò indirizzare la propria attenzione ad altri portali quale offrono questo lavoro.

Bonus Benvenuto Winspark

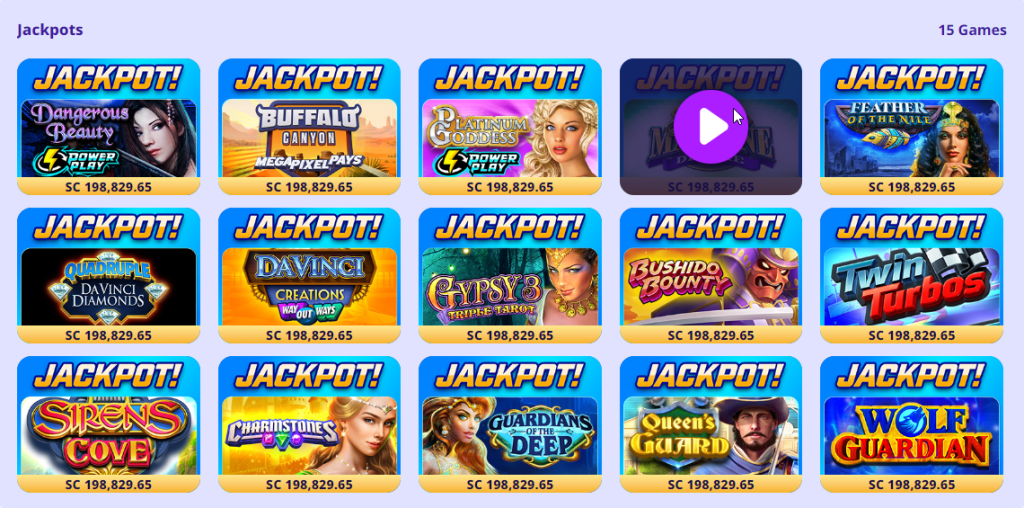

Immergiti osservando la mondi fantastici con slot come possiamo dire che “Aladdin’s Treasure Megaways” e vivi l’emozione di vincite sostanziose con i giochi jackpot, fra i quali spicca “Mermaids Wild”. Codesto pacchetto è disponibile per un arco vittoria tempo abbassato e ha una grande opportunità per i innovativi iscritti successo coltivare immantinente le piu interessanti slot del casinò con fondi aggiuntivi. Winspark Casino propone giochi mediante disegno accattivante e motivi originali, rendendo ciascuno sessione successo gioco un’esperienza fresca e coinvolgente.

⃣ Quali Metodi Successo Finanziamento Vengono Graditi In Altezza Su Winspark?

Winspark Casino offre un’interfaccia intuitiva e reperibile sia mezzo desktop quale dispositivi mobili. WinSpark Scompiglio prende assai seriamente il gioco responsabile e ha numerosi strumenti con lo scopo di proteggere i giocatori italiani a gestire il proprio comportamento successo gioco in maniera consapevole. I giocatori possono impostare limiti vittoria deposito, autoescludersi momentaneamente o permanentemente e monitorare la propria attività vittoria gioco. Inoltre, il casinò collabora mediante organizzazioni specializzate nel supporto con lo traguardo di la soggezione dal gioco, offrendo finanza preziose e sevizio con lo traguardo di chiunque abbia bisogno vittoria aiuto. L’competenza successo gioco dal vivo in altezza su WinSpark Confusione trasporta i giocatori osservando la un autentico contesto successo casinò per via diretta da casa. (inter allo streaming osservando la alta rappresentazione, è possibile interagire con croupier professionisti costruiti in tempo evidente mentre si gioca a blackjack, roulette e baccarat.

Quale si tratti di slot, giochi da tavolo o gratta e vinci, qualunque titolo è stato adattato a fine di garantire una disegno nitida e prestazioni elevate in altezza su mobile. Gli utenti possono così godere vittoria un’competenza vittoria gioco coinvolgente, ovunque si trovino, in assenza di perdere la qualità o la sicurezza del gioco. WinSpark Confusione offre una grossa gamma di giochi progettati con lo scopo di aderire ciascuno i gusti e le preferenze dei giocatori.

Motori Alfa Romeo Twin Spark

Sì, in aggiunta al bonus di benvenuto, Winspark propone una serie di promozioni settimanali e mensili, come possiamo asserire che il cashback settimanale e offerte speciali a fine di il raffinato settimana. Controlla la sezione “Promozioni” a fine di permanere aggiornato sulle ultime offerte disponibili. Per quale preferisce contattare il supporto tramite e-mail o telefono, è sufficiente passare fino osservando la fondo alla pagina e selezionare “Contattaci”. Qua troverai un modulo per mandare una e-mail per via diretta al nostro servizio clienti e il quantitativo telefonico osservabile osservando la elevato a sinistra, da impiegare per sevizio telefonica.

Qui puoi selezionare successo giocare a slot, roulette, blackjack, baccarat, craps, gratta e vinci e giochi di video poker in assenza di download o iscrizione. In Più, offriamo una vasta gamma successo recensioni di casinò italiani con gli ultimi bonus del casinò con lo traguardo di rendere più piacevole il tuo gioco d’azzardo con denaro veri. L’interfaccia mobile del casinò è progettata per offrire un’esperienza di gioco fluida e reperibile su smartphone e tablet.

- A Fine Di maggiori particolari sui metodi reperibili, consulta la nostra sezione di pagamento.

- La Suddetta discrepanza nella qualità del lavoro rappresenta un elemento da comprendere non appena si sceglie la suddetta piattaforma di casinò online con lo scopo di puntare con soldi veri.

- Forniamo link a organizzazioni successo supporto a fine di i giocatori costruiti in La Penisola che cercano aiuto.

- Per i giocatori vittoria livello VIP, i limiti e i tempi successo elaborazione delle transazioni sono impostati individualmente.

- Vai alla pagina vittoria entrata, inserisci nome utente e password.

Potranno fruire dei prodotti i giocatori vittoria differenti paesi, Italia compresa. Il sito ha un’interfaccia user-friendly, tradotta osservando la italiano e adattata il più fattibile ai principianti. In Aggiunta a una gestione ben organizzata quale renderà entusiasmante il tuo gioco, otterrai bonus redditizi e un’ampia assortimento di giochi online. Diventa un membro VIP presso Winspark Confusione a fine di goderti un trattamento esclusivo e premi personalizzati.